We are in a health crisis, and entering an economic crisis. Emergency Money to the People provides the financial support that Americans need now.

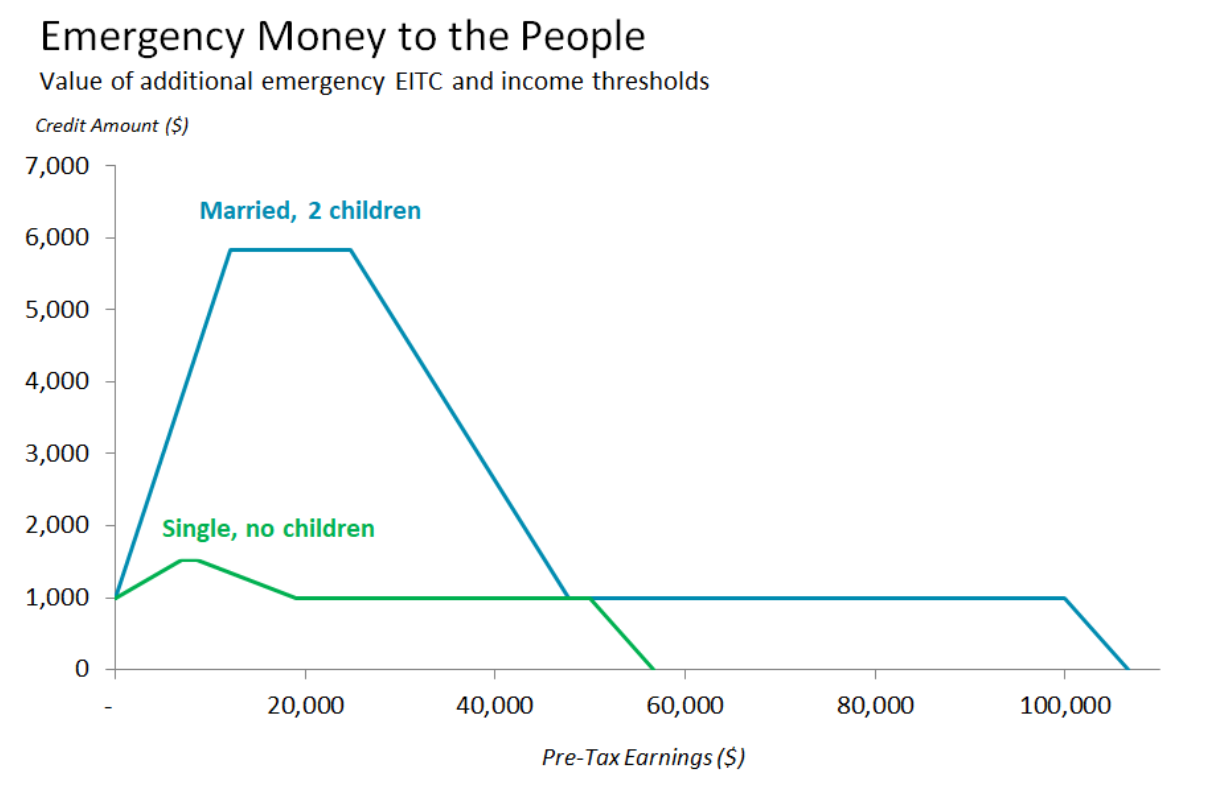

As families and communities deal with the coronavirus outbreak and resulting economic toll, we must provide immediate financial support to the millions of American families who were already living paycheck-to-paycheck before this crisis unfolded. Emergency Money to the People builds on the Earned Income Tax Credit’s proven track record of delivering help to those who need it most. This emergency EITC would put at least $1,000 into the pockets of people earning up to $100,000 – two-thirds of all Americans – quickly helping to stabilize families most at risk in this crisis while also boosting the economy.

FACT SHEET: Money for the people who need it

POLICY SUMMARY: Ensuring Stimulus Goes To Those Who Need It Most

RESPONDING TO A CRISIS

Families are preparing for disruptions to their daily lives as the coronavirus spreads across communities, and low- and moderate-income people who have little or no savings to fall back on will be hardest hit. For people already struggling to make ends meet, the oncoming disruptions could be disastrous. Even without an economic crisis, nearly four in ten Americans can’t afford a $400 emergency expense. We need to act now to stabilize these families and provide an income boost so that people have the resources necessary to meet their needs. Emergency Money to the People immediately provides money to those who need it most is the best tool we have to quickly stabilize families, communities and our economy.

WHY WE NEED EMERGENCY MONEY TO THE PEOPLE

With fears that the coronavirus will push the U.S. economy into a recession, and discussions in Washington about policy solutions to help people and industries impacted, it is vital that any economic stimulus package focus on Main Street, not Wall Street. Any stimulus package must be targeted to help the low- and middle- income people facing the biggest economic disruption, deliver quick relief, and maximize the economic boost.

The Earned Income Tax Credit (EITC) is America’s most successful anti-poverty program for workers, lifting people out of poverty for the past 40 years. Using the EITC to provide Emergency Money to the People delivers most of its benefits to the bottom half of earners, targeting dollars most effectively while reducing inequality, stimulating the economy, and counterbalancing recessionary impacts that hit people of color the hardest.

An expansion and modernization of the EITC has historically received bipartisan support. Congress can enact simple temporary changes to broaden eligibility and deliver the benefits more quickly.

The EITC is a proven, shovel-ready recession-fighter. Because it’s targeted to those most likely to spend rather than save, Emergency Money to the People would provide more stimulus per dollar spent compared to a payroll tax cut (which would benefit the wealthy much more than low-wage workers) or an across-the-board rebate. Paying Emergency Money to the People quarterly also gives people money when they need it, so they can pay for things like rent, medicine, and groceries, and boosts spending rather than saving.

Of course, the government must immediately act to tackle the health impacts and stop the spread of the coronavirus crisis. This means paid sick leave, free testing and adequate health care, and other emergency responses such as expanded Unemployment Insurance and food security programs. Emergency Money to the People should complement these immediate health responses to ensure that families can weather this economic storm.

HOW EMERGENCY MONEY TO THE PEOPLE WORKS

The EITC is already designed to get cash in the hands of the lowest-wage workers who will be hit the hardest by an economic downturn. Important work by the Urban Institute and economist Darrick Hamilton identifies key modifications we can make temporarily so the EITC can deliver immediate and ongoing help Americans will need to weather the economic shock:

More money

It would give an additional EITC to all current EITC recipients, based on 2019 tax returns, at least doubling their 2020 credit.

It would give a deep poverty boost to the lowest-income Americans who are already facing the worst effects of the economic crisis. Families starting at $0 of earned income that are not currently eligible for the EITC would receive at least $1,000.

More people

It would expand eligibility to more in the middle class, including individuals earning up to $50,000 without children and couples earning up to $100,000 with children. Many of these Americans live with no financial cushion.

It would remove the exclusions for younger and older adults without children, and for immigrant taxpayers who file using an ITIN.

More quickly

Half of the new credit would be paid out immediately, and the rest would be paid out in two equal quarterly payments, making the stimulus both immediate and lasting.

It would provide a simple online form to get the credit out more quickly for new EITC recipients without dependents.